Observe: This text comprises authorized recommendation. We suggest you seek the advice of a lawyer earlier than making authorized selections in your small business.

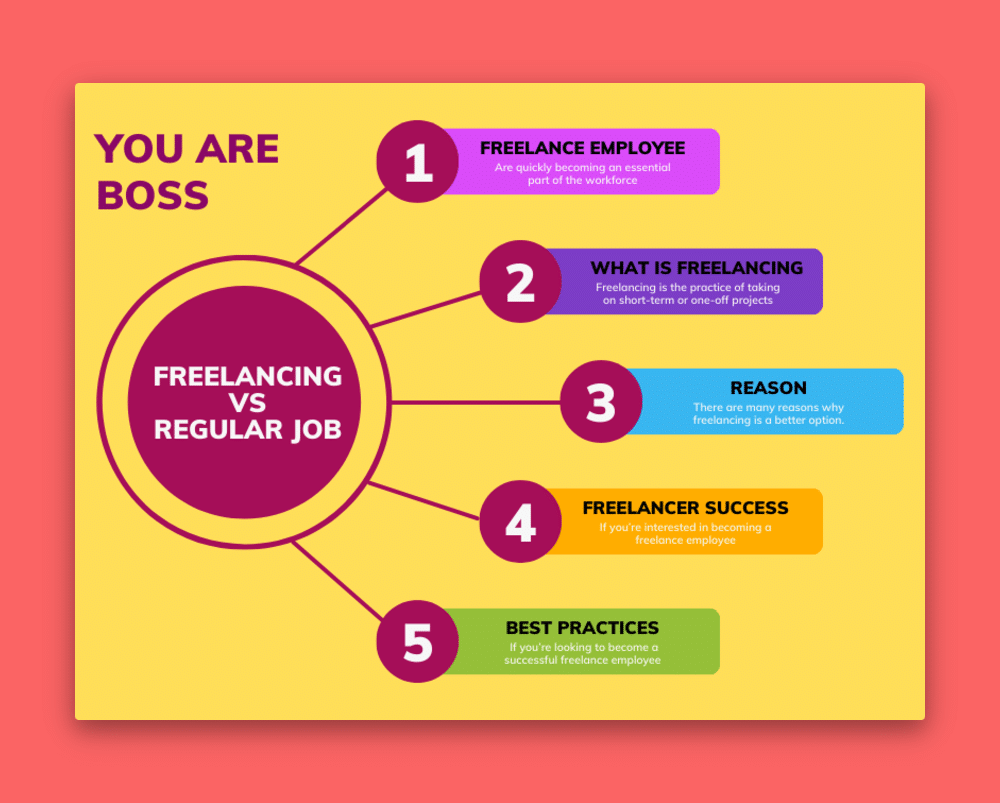

Freelancing is on the rise like by no means earlier than. In 2023, 73% of U.S. employees deliberate to freelance. An astonishing 46% of the worldwide workforce is self-employed. In 2023, 72% of Gen Zers deliberate to depart their jobs to work for themselves. These numbers present that freelancing is greater than a pattern. It’s shaping the way forward for how and the place we work.

The enchantment is plain: flexibility, autonomy, and the possibility to be your individual boss. However freelancing is extra than simply choosing a service to supply or setting your individual hours. It’s good to start with a robust basis to construct a profitable, sustainable freelance enterprise. The secret is to construction your small business correctly from the outset.

Many freelancers first arrange an LLC to professionalize their enterprise. An LLC gives authorized safety, tax benefits, and credibility with purchasers. However, the method will be difficult. Frequent errors can have expensive results.

Get Weekly Freelance Gigs by way of E mail

Enter your freelancing handle and we’ll ship you a FREE curated listing of freelance jobs in your prime class each week.

This text will cowl six frequent errors individuals make when beginning a contract LLC. Most significantly, we’ll present you easy methods to keep away from them. This can assist you arrange your freelance enterprise for long-term success.

Why must you arrange an LLC?

For freelancers, an LLC is an effective way to guard your small business and private belongings. An LLC separates your private and enterprise funds. It protects your private home, financial savings, and belongings from money owed or lawsuits tied to your freelance work.

Past safety, an LLC additionally boosts your skilled picture. Shoppers see LLCs as extra credible than sole proprietors. So, it’s simpler to get high-paying contracts and long-term relationships. This added professionalism can set you aside from opponents and open the door to extra alternatives.

An LLC additionally brings important tax advantages. It permits for pass-through taxation. Enterprise earnings is reported in your private tax return. This may increasingly simplify your tax course of. If you happen to earn extra as a freelancer, select S-Corp tax in your LLC. It could possibly cut back your self-employment tax and prevent cash as your small business grows.

Lastly, an LLC prepares you for progress. Whether or not you intend to rent subcontractors, kind partnerships, or broaden your companies, an LLC gives the pliability and construction you’ll must succeed.

It’s a foundational step that positions your freelance enterprise for long-term success. Even should you’re simply promoting digital merchandise on-line or doing occasional gig work like consulting or graphic design, it’s price contemplating establishing an LLC to guard your rising enterprise.

What do it’s essential to arrange an LLC?

Organising an LLC might sound daunting at first, however with the proper preparation, it’s a simple course of. Listed here are six key parts you’ll must get began and guarantee your freelance enterprise is on strong authorized floor.

1. Select your small business identify

Each LLC wants a novel enterprise identify that complies along with your state’s laws. The identify mustn’t solely mirror your companies but additionally stand out to purchasers.

Remember to verify your state’s database for availability and make sure that the identify contains “LLC” or “Restricted Legal responsibility Firm” to fulfill authorized necessities.

At the side of establishing your small business identify is securing a website identify in your web site. If your required area isn’t out there, or if it’s too lengthy or onerous to recollect, think about using a artistic, memorable different.

For instance, HJV Automotive Accident Private Harm Legal professionals opted for a novel URL, justicestartshere.com, to face out whereas holding issues easy and efficient.

By selecting a website that’s catchy and related, you make it simpler for potential purchasers to seek out and keep in mind your small business on-line.

2. File articles of group

The Articles of Group (additionally known as a Certificates of Formation in some states) is the official doc that establishes your LLC. You’ll need to file this along with your state and pay a submitting price, which varies by location.

This doc outlines your small business identify, handle, and the identify of your registered agent (an individual or service licensed to obtain authorized notices in your behalf).

3. Create an working settlement

Though not at all times legally required, an working settlement is an important doc that lays out the construction and operations of your LLC.

It helps make clear roles, obligations, and decision-making processes, particularly should you plan to broaden or deliver on companions later.

4. Get hold of an EIN

An Employer Identification Quantity (EIN) from the IRS is critical for tax functions. Even should you don’t have workers, an EIN lets you open a enterprise checking account and simplify tax reporting.

The excellent news? It’s free to use on-line via the IRS web site.

5. Collect your documentation

Gathering and managing your small business paperwork is a key a part of the LLC setup course of. Instruments like Content material Snare can simplify this step by serving to you request and set up all crucial recordsdata, equivalent to contracts, working agreements, and tax varieties, in a single place.

6. Perceive state-specific necessities

LLC laws differ from state to state, so it’s essential to analysis your state’s particular guidelines. Some states require annual experiences or franchise taxes, which ought to be factored into your funds and timeline.

Is there an opportunity you’ll function in a number of states? An organization like Zehl & Associates is a legislation agency that serves purchasers throughout america and should pay attention to nuances in LLC necessities in numerous states. Be certain you verify state necessities in each state the place you’ll do enterprise.

6 errors freelancers make when establishing an LLC

If you wish to survive and thrive as a freelancer, then it’s essential to set your small business up for fulfillment from the get-go.

Let’s look into 6 errors freelancers make when establishing an LLC and what you are able to do to keep away from making these identical errors.

Mistake #1: Selecting the improper enterprise construction

One of many first and most essential selections for a freelancer is choosing the proper enterprise construction. Many soar into freelancing as sole proprietors as a result of it’s simple to arrange. However, that doesn’t at all times present the safety or flexibility wanted as your small business grows.

An LLC is best than a sole proprietorship. It protects your belongings and boosts your credibility. Some freelancers select an LLC. They don’t contemplate if an S-Corp tax election may swimsuit them higher. For instance, in case your freelance enterprise makes good cash, an S-Corp may cut back your self-employment taxes. It may assist you preserve extra of your earnings.

One other mistake is overcomplicating issues by selecting a C-Corp. It’s pointless for many freelancers. C-Corps face double taxation and further guidelines. They conflict with the simplicity freelancers search.

The secret is to evaluate your present and future enterprise targets. If you need restricted legal responsibility, manageable taxes, and room for progress, an LLC is usually the very best match. A enterprise legal professional or tax skilled will help. They’ll make sure you select a construction that helps your long-term success.

Mistake #2: Not understanding state and native LLC legal guidelines

Every state has its personal guidelines for LLC formation, taxes, and ongoing compliance. Not figuring out these guidelines can result in penalties, prices, or shedding your LLC’s good standing. This error typically stems from assuming all states function the identical approach, however the actuality is much extra nuanced.

Some states will need to have annual experiences and franchise taxes. Others have low charges and fewer frequent reporting. Additionally, contemplate native legal guidelines (like metropolis enterprise licensing necessities). Working in lots of places provides complexity. You have to guarantee compliance in each state or metropolis the place your small business operates.

Contemplate Attorneys of Chicago, a legislation agency with places of work in a number of cities in Illinois. Their robust presence throughout a state is a bonus for his or her enterprise, nevertheless it means they have to pay attention to distinctive legal guidelines in numerous cities and counties. If you happen to to develop your attain and turn out to be an LLC in a number of places, you have to navigate these points.

To keep away from any errors right here, analysis your state’s necessities earlier than establishing your LLC. If you happen to plan to work with purchasers outdoors your private home state, seek the advice of a lawyer to make sure compliance. Staying proactive about state and native legal guidelines helps shield your LLC. It additionally ensures easy operations wherever you do enterprise.

Mistake #3: Skipping or underestimating insurance coverage wants

Don’t overlook the significance of insurance coverage when establishing an LLC. It’s a crucial security internet. With out satisfactory protection, you’re leaving your small business and private belongings uncovered to potential dangers.

As an illustration, if a shopper sues over a mistake in your work, skilled legal responsibility insurance coverage can cowl authorized charges and damages. Basic legal responsibility insurance coverage protects you from claims of bodily damage or property injury. Each can come up from on a regular basis enterprise interactions.

Even when your freelance work is completely on-line, dangers nonetheless exist.

Get insurance coverage that matches your wants. It may very well be common legal responsibility, skilled legal responsibility, and even medical insurance (for your self or employees you probably have one). Merely, insurance coverage protects your LLC. When you’re protected, you may give attention to rising your small business with out fear.

Mistake #4: Mixing private and enterprise funds

A standard mistake freelancers make when establishing an LLC just isn’t separating private and enterprise funds. Utilizing your private checking account for enterprise transactions could appear handy. However, it could actually blur the traces between your private and enterprise belongings.

This not solely complicates your accounting however may also weaken the legal responsibility safety your LLC gives.

To keep away from this, begin by opening a devoted enterprise checking account. Use this account just for enterprise earnings and bills. It helps you monitor your funds, handle taxes, and preserve data. Most banks supply enterprise accounts for small companies and freelancers. They typically embrace perks like on-line banking and accounting software program integrations.

Subsequent, set up a system for managing funds. Instruments like invoicing software program and finance apps can simplify monitoring earnings and bills. These instruments assist you spot developments in your earnings. Additionally they assist you plan for tax funds and preserve your small business worthwhile.

Lastly, keep in mind that consistency is vital. Retaining your funds separate isn’t only for simpler taxes. It exhibits purchasers, collaborators, and traders that you just run knowledgeable, organized operation. Doing this earlier than you launch as an LLC will prevent time and stress. It’ll additionally forestall any potential authorized issues afterward.

Mistake #5: Ignoring tax obligations and overlooking attainable deductions

Taxes could be a daunting a part of freelancing. For brand new LLC house owners, they are often much more difficult. Not figuring out your tax obligations or lacking deductions can waste money and time.

As an LLC proprietor, you have to pay self-employment taxes. This tax covers Social Safety and Medicare. Moreover, it’s possible you’ll must make quarterly estimated tax funds to keep away from penalties on the finish of the yr. The secret is to remain organized and plan! Think about using accounting software program or hiring a tax skilled that can assist you handle your obligations.

One of many perks of an LLC is the power to say a variety of tax deductions. Frequent deductions embrace house workplace bills, web and telephone payments, software program subscriptions, skilled improvement programs, and journey prices for work. Retaining detailed data of your small business bills will assist you save. It’ll make sure you don’t miss precious alternatives to take action.

In fact, you need to be sure that no matter you deduct out of your taxes is a real enterprise expense. Don’t attempt to cheat the system. It could possibly put your private and enterprise funds in danger and isn’t price it.

If you happen to’re overwhelmed by taxes, seek the advice of a CPA. One with small enterprise expertise will help so much. They will help you with advanced tax guidelines, optimize your deductions, and determine in case your LLC ought to elect S-Corp standing to chop self-employment taxes. Proactive tax planning is an funding in your small business. It helps you keep compliant and maximize your income.

Mistake #6: Neglecting to hunt skilled assist when wanted

As a freelancer working an LLC, you could be tempted to do the whole lot your self. However this could result in expensive errors. Professionals like attorneys and accountants can shield your small business from avoidable dangers.

A lawyer will help you create robust contracts, guaranteeing you’re protected in case of disputes with purchasers. An accountant will help you perceive tax legal guidelines, discover deductions, and arrange a monetary plan that matches your small business wants.

With out knowledgeable steering, you danger making expensive errors, whether or not it’s submitting taxes improper or utilizing ineffective contracts. However getting skilled assist doesn’t should be costly. There are inexpensive companies out there for small enterprise house owners, equivalent to on-line authorized platforms or freelance accountants.

Investing in skilled assist on the proper time can prevent cash and forestall greater issues down the highway. Don’t watch for a problem to come up. Search recommendation early to assist shield your LLC and provide you with peace of thoughts as your small business grows.

Bonus tip: Don’t overlook branding and advertising and marketing as you arrange your LLC

Whereas structuring your LLC is essential, neglecting your branding will be an equally expensive mistake. Your model is the face of your small business, and it’s typically the primary impression purchasers have of your work. From day one, branding units the tone for the way your freelance enterprise will join with its viewers and stand out in a crowded market.

Your model is how purchasers understand and join with your small business. It’s greater than only a emblem or identify—it’s the story, tone, and values that set you aside. Consistency is essential, as seen with DLG Workforce, which makes use of cohesive branding throughout platforms, reinforcing professionalism and memorability.

When purchasers transfer from web site to social media, it’s essential to keep up consistency with shade schemes, graphics, and message tone. Discover how their Instagram web page displays their web site:

A powerful model additionally tells a narrative: why you freelance, what makes your companies distinctive, and the way you resolve shopper issues. Paired with efficient advertising and marketing, your branding can set up authority and assist you attain the proper viewers on the proper time.

To achieve success:

- Select a memorable identify for your small business

- Design a emblem and choose colours that signify your identification and vibe

- Develop model requirements to make sure uniformity throughout your web site, emails, and advertising and marketing supplies

- Create a mission assertion and outline the tone of voice you’ll use in all communications.

Consistency is vital—your model ought to be immediately recognizable throughout all platforms. A cohesive, compelling model not solely enhances credibility but additionally builds belief and helps your LLC thrive in the long run.

Then there’s all of the advertising and marketing of your model that you just’ll do. Advertising and shopper outreach are crucial for freelancers trying to stand out. If you happen to’re not sure easy methods to develop your small business, contemplate leveraging assets like startup search engine marketing methods to reinforce your on-line visibility. Moreover, instruments like automated e mail advertising and marketing platforms can simplify communication and assist create robust relationships along with your prospects.

Don’t go away branding and advertising and marketing as an afterthought. Deal with it as an integral a part of your marketing strategy, similar to establishing your LLC. If you happen to do, you’ll lay the groundwork for long-term enterprise success.

Wrapping it up

Beginning an LLC out of your freelance work is an enormous step in the direction of professionalizing your small business and securing each your private and enterprise belongings. Nevertheless, frequent errors can hinder your success. By avoiding the errors we talked about on this article, you may keep away from expensive errors. Moreover, establishing robust branding and a advertising and marketing plan from the beginning can set you aside in a aggressive market.

Bear in mind, establishing your LLC is only the start. Ongoing analysis, planning, and in search of knowledgeable recommendation will make sure you’re on monitor for long-term success. Take the time to set your freelance enterprise up appropriately, and it’ll repay as your small business grows.

If you happen to’re uninterested in the cubicle life and able to do work you’re keen on, make greater than you ever thought attainable, and luxuriate in final freedom, Millo is the proper place for you. Be part of our neighborhood right this moment by subscribing to our publication, and switch your freelance work into your full-time enterprise.

Hold the dialog going…

Over 10,000 of us are having day by day conversations over in our free Fb group and we would like to see you there. Be part of us!