Staying on high of your payments is crucial if you wish to enhance your funds. Rocket Cash can monitor your due dates and monitor the way you spend your cash so you possibly can keep away from sudden bills.

The app may also aid you cancel undesirable subscriptions, make a finances, and supply customized strategies to enhance your spending habits. These free and premium options are helpful in the event you’re on a good finances.

Our Rocket Cash evaluation reveals how the varied app options may also help decrease your month-to-month payments and which membership tier is good on your wants.

What’s Rocket Cash?

Rocket Cash is a private finance app that was initially launched in 2015 as Truebill. The app rebranded underneath its present identify in 2022 after being acquired by Rocket Firms.

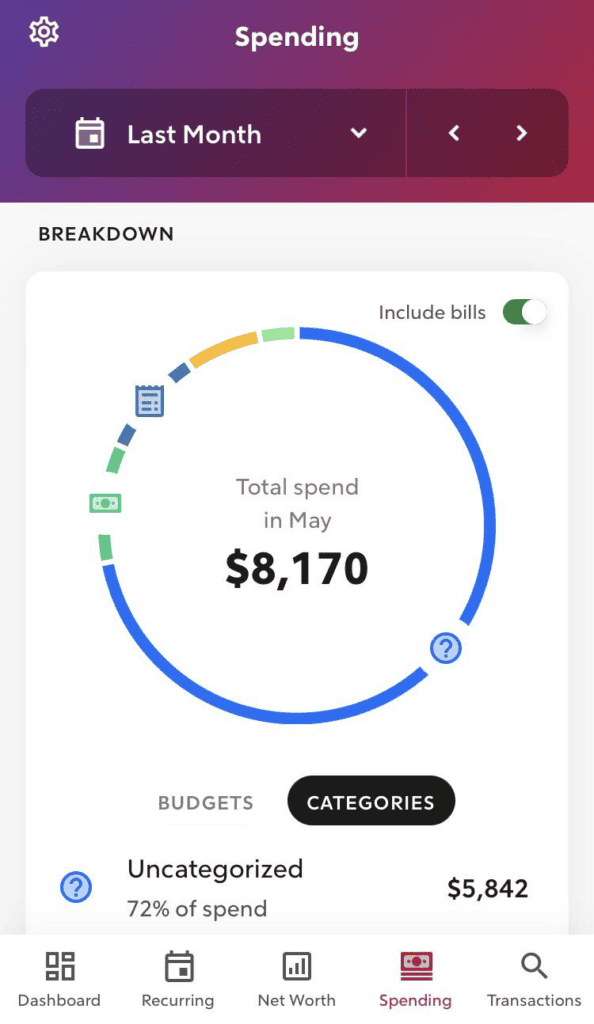

It connects to your financial institution accounts and bank cards to obtain latest bills, retrieve your present account balances, and forecast your month-to-month spending. You may see the small print in easy-to-read charts you could categorize for elevated accuracy.

This cash app additionally supplies customized strategies that can assist you lower your expenses, equivalent to lowering recurring bills.

How Does the Rocket Cash App Work?

Rocket Cash is mobile-only and accessible from Android or iOS smartphones and tablets. You may join from an internet browser however should obtain the app to hyperlink your accounts and make the most of the finance instruments.

There are free and paid pricing plans that supply varied cash administration instruments specializing in lowering bills and planning for future purchases.

Core options obtainable to all members embrace:

- Account steadiness syncing

- Invoice negotiation

- Budgeting

- Canceling undesirable subscriptions

- Credit score rating monitoring

- Downloading transactions

- Payment refunds

- Cost reminders

You may simply hold tabs in your spending, create a finances, and obtain customized insights with this free budgeting app.

A premium subscription makes assessing your full monetary image simpler since there are extra automated options to scale back present bills and plan long-term monetary objectives. Moreover, a paid membership is required for joint accounts.

A number of the platform’s premium instruments embrace:

- Automated financial savings

- Cancellation concierge

- Creating limitless budgets

- Credit score report updates

- Exporting information

- Web price monitoring

- Premium chat customer support

- Actual-time account steadiness updates

- Shared accounts

Should you want limitless app entry or the comfort of automated options, the paid subscription is healthier.

How A lot Does Rocket Cash Value?

The free model by no means incurs charges, however you’ll have restricted capabilities. For instance, you possibly can solely make a fundamental finances and may’t request on-demand account updates.

For any paid membership, you select how a lot you wish to pay based mostly on what you assume is truthful.

The app presents a seven-day free trial to determine in the event you’ll profit from the in-depth options, together with the flexibility to create limitless budgets, web price monitoring, and extra hands-on buyer help.

Upgrading to Rocket Cash Premium prices between $3 and $12 month-to-month. An annual subscription prices $36 or $48 and is billed upfront.

Though it’s an non-obligatory service, a one-time payment applies when the invoice negotiation characteristic efficiently lowers a recurring subscription like your cable or cellphone invoice.

Options

Listed below are the varied instruments that may aid you take higher management of your monetary life.

Account Syncing

You can begin by linking your financial institution, bank card, and funding accounts to the app. The service makes use of Plaid to attach securely. It’s doable to exclude particular accounts that you just don’t use to pay payments or don’t need the app to observe for privateness.

After connecting to your monetary establishment, the free plan updates your account balances and transactions every day. Compared, premium members have on-demand entry and may see their real-time steadiness all through the day.

Having the ability to hyperlink your accounts free of charge is one in every of this app’s most dear options since you possibly can monitor each buy and know precisely the way you spend your cash.

Invoice Negotiation

The negotiation service is initially free for all customers and is an easy solution to see in the event you qualify for reductions on costly recurring subscriptions. Then, after analyzing your spending habits, the app will immediate you when it believes it might probably cut back an expense.

Contract-based cellphone plans, cable TV, and residential web have essentially the most financial savings potential as a result of current prospects normally pay larger charges than new prospects.

After linking your service account or importing a latest month-to-month invoice, a billing knowledgeable will see if reductions or newer plans can supply comparable providers at a decrease month-to-month value. If that’s the case, you pay a one-time success payment of 30 to 60 p.c of the annual financial savings.

This payment is just like different invoice negotiation providers that cut back or cancel recurring bills. Whereas it’s an expense, you spend much less cash and save time by not contacting service suppliers by yourself.

Subscription Monitoring

Free and paid customers may also monitor how a lot they spend month-to-month on recurring payments like their telephone, web, or streaming providers. Tapping on a selected supplier permits you to see how a lot you spend per 30 days and is a straightforward solution to search for billing will increase.

This instrument may also help establish undesirable subscriptions you could wish to cancel or renegotiate for a decrease payment. For instance, there could be a streaming service you haven’t watched in a number of months and thought was already canceled.

The app supplies detailed steps to cancel subscriptions at no additional value. You may faucet a button to name the cancellation line or go to the cancellation web page to submit your request.

Premium members can benefit from the subscription cancellation concierge, the place the app robotically cancels a service at your request. This protects you time and allows you to keep away from a disturbing telephone name the place the consultant might stress you to remain.

Requesting Refunds for Charges and Outages

Rocket Cash searches for potential overdraft and late charges in your banking historical past that may be eligible for a refund. Free customers can entry a script to learn when calling an establishment to request a refund.

It’s even doable to request partial refunds throughout service outages, like when your satellite tv for pc or web service is unavailable for a number of days.

With the premium plan, the app will robotically attempt to request refunds and credit in your behalf.

Budgeting

You may create a fundamental finances that helps stop you from overspending. This characteristic is beneficial for an off-the-cuff finances that requires minimal upkeep.

The free and paid budgeting instruments gained’t present the in-depth insights and planning options that different premium finances software program presents. People who want hands-on assist to create a spending plan or map out monetary objectives might discover Rocket Cash insufficient.

Free customers can break down their spending into 4 classes:

- Payments and utilities

- Groceries

- Charges

- The whole lot else

The finance app will measure your remaining earnings for the month and your projected financial savings. These instruments are adequate if you wish to monitor spending, however different free budgeting software program can present extra in-depth options in the event you want higher element.

Paid customers can create limitless budgeting classes and categorization guidelines. This customization could make it simpler to know precisely how a lot you might be spending on sure bills while you’re critical about saving extra money.

Automated Financial savings

Premium customers can schedule recurring deposits for financial savings objectives right into a Good Financial savings account. You may select the deposit quantity and frequency. Moreover, the app shows your financial savings progress and offers you full account management.

The cash transfers from a linked checking account right into a financial savings account at a accomplice financial institution that’s FDIC insured. An overdraft safety system gained’t provoke transfers when it suspects there gained’t be sufficient remaining funds to pay your payments.

You may make a number of accounts if you wish to save for a number of objectives. As an example, you might need a trip fund and one other for a substitute car.

Observe Your Web Value

Along with being a budgeting app, the premium plan has a web price tracker that calculates the worth of your liquid belongings, equivalent to your financial savings and investments. You may manually add accounts and loans and replace the steadiness as obligatory.

It’s straightforward to allow a number of toggles to exclude sure belongings out of your web price complete. As an example, it’s regular to not rely the worth of your major residence, car, or checking account because you gained’t promote them to speculate or pay for bills.

This characteristic may also help monitor your general monetary progress as you cut back discretionary spending, repay debt, and prioritize financial savings objectives.

Credit score Rating Monitoring

All customers can view their free credit score rating and chart their rating historical past within the app. It updates month-to-month and is the VantageScore 3.0 that makes use of your Experian credit score report.

Premium subscribers can view their full credit score report, which refreshes month-to-month. Seeing your full report permits you to search for reporting errors and any detrimental marks.

How Reliable is Rocket Cash?

Rocket Cash protects your information utilizing bank-level encryption and multifactor authentication (MFA). Additionally they use Plaid, which is a trusted third-party service, to sync your account and keep away from storing delicate info on the app’s servers.

These safety measures don’t make the app breach-proof, however the practices are just like different private finance platforms.

One other potential concern for people may be privateness. Your identification stays nameless, however you could obtain adverts and product presents from Rocket Firms and third-party companions for loans, investments, or different monetary providers.

Professionals and Cons

Listed below are among the app’s strengths and weaknesses.

Professionals of Rocket Cash

- Free budgeting and expense-cutting instruments

- Syncs with financial institution accounts and bank cards

- Customizable budgets and categorizations

- Simple to make use of

Cons of Rocket Cash

- Restricted free options

- A number of instruments require a paid membership

- Budgets are too easy for critical planning

- Cellular-only

Should you need assistance managing your cash and streamlining your bills, Rocket Cash may very well be price a strive.

Apps Like Rocket Cash

Rocket Cash makes it straightforward to observe your spending and search for methods to chop prices. Nonetheless, sure customers may discover its options missing and should profit from different platforms .

Right here’s a preview of the highest decisions:

These are one of the best alternate options to Rocket Cash.

YNAB

You Want a Price range (YNAB) is a favourite for people who want hands-on assist making an in-depth finances. This app’s major objective is that can assist you cease dwelling paycheck to paycheck and assign every greenback you earn a job to maximise your financial savings.

This platform is accessible by pc or cellular system. After becoming a member of, it walks you thru an intensive setup course of to allocate your month-to-month finances for frequent and fewer frequent bills.

It connects to your monetary accounts, and there are numerous colourful charts to visualise your progress.

The service is free for the primary 34 days and prices $14.99 month-to-month or $99 when paid yearly. School college students get pleasure from 12 months of complimentary entry.

Tiller

Think about Tiller Cash in the event you want spreadsheet budgets utilizing Google Sheets or Microsoft Excel. First, you hyperlink your banking accounts. Then, the app robotically imports your transactions right into a common finances template.

Subsequent, you possibly can create totally different sheets to trace particular transaction sorts or pursue a number of budgeting methods. You may implement auto-categorization guidelines or community-created templates to make it simpler to trace your earnings and spending.

After the primary 30 days, an annual subscription prices $79.

Empower

Empower (previously Private Capital) is a free finance app. You solely pay charges in the event you use its wealth administration providers for investing.

Most individuals use this platform to trace their web price, make a fundamental finances, and obtain a complimentary funding portfolio evaluation.

Empower permits you to create a fundamental finances with limitless classes and account syncing. Of the three Rocket Cash alternate options, it has essentially the most restricted budgeting capabilities, but it surely’s perfect for evaluating your month-to-month spending and earnings.

The free web price tracker is among the greatest since you possibly can effortlessly monitor liquid and bodily belongings. There’s additionally an entry-level retirement planner and financial savings objectives to map your monetary future.

Learn our Empower evaluation to be taught extra.

Rocket Cash Overview

-

Ease of Use

-

Instruments and Assets

-

Commissions and Charges

-

Buyer Service

-

Availability

Rocket Cash Overview

Rocket Cash is a helpful private finance app that helps you handle your finances and establish providers to cancel and payments to barter to extend your financial savings.

Professionals

✔️ Free to make use of

✔️ Customizable budgets

✔️ Syncs with monetary accounts

✔️ Intuitive interface

✔️ Budgeting instruments are free

Cons

❌ Not all choices are free

❌ Cellular solely

❌ It’s possible you’ll want extra superior budgeting options

Backside Line

You’ll profit essentially the most from utilizing Rocket Cash if you wish to monitor your bills by a particular transaction or search for methods to scale back spending on recurring payments.

The app’s budgeting instruments are adequate for making a starter spending plan that’s straightforward to observe and perfect for informal customers who could be intimidated by extra refined and pricier platforms.

There’s a seven-day free trial to check drive the app and determine if the free or paid model is a greater match on your monetary objectives. With no danger to provide it a strive, it’s price testing.

What do you search for in a cash administration app?

Josh makes use of his private expertise of paying off over $130,000 in private debt and altering careers to write down about saving cash, investing, and paying off debt. He has recurrently written for notable shops together with Pockets Hacks, Properly Saved Pockets, and Debt Roundup.

Josh was beforehand an operations supervisor for a Fortune 500 firm for seven years. He’s married with three young children.

Associated